As the global economy settles into a phase of modest yet steady growth-projected at 3% GDP in 2026 by the IMF-India continues to outpace its peers, standing tall among the world's fastest-growing major economies. The National Statistical Office (NSO) estimates India's GDP will grow by 6.4% in FY2025, following an impressive 8.2% expansion in FY2024. However, headwinds such as fiscal tightening and uncertain global trade environment could moderate growth to around 6.5% in the near term.

Against this backdrop, microfinance has emerged as a vital engine of financial inclusion and grassroots economic development. By extending small, collateral-free loans to underserved communities, microfinance institutions (MFIs) are bringing formal credit within reach for millions who remain beyond the purview of traditional banking. As of March 2025, the sector's gross loan portfolio had crossed ₹3.75 lakh crore (Source: Equifax Microfinance Industry Insights March'25), serving an estimated 79 million borrowers. Yet even at this scale, the industry believes only about 35% of the potential market has been tapped. A striking 99% of these borrowers are women, amplifying the sector's role in fostering women's empowerment and economic independence. When extrapolated to household and community impact, this translates to over 300 million lives touched and employment opportunities created for an estimated 120 million people-a cornerstone contribution to India's development priorities.

To understand the moral underpinning of microfinance, one needs only to recall Mother India (1957), the iconic Hindi film where Radha, a poor but dignified woman, battles adversity and resists the exploitation of a predatory moneylender. Today, it is upon the shoulders of countless such "Radhas" that India's microfinance sector stands resilient.

But despite significant progress, microfinance in India is yet to realize its full potential - especially as India marches toward its vision of Viksit Bharat by 2047, microfinance must evolve from being a support system to becoming a central pillar of inclusive, sustainable development. While initiatives such as Pradhan Mantri Jan Dhan Yojana, which has facilitated over 50 crore bank accounts, Pradhan Mantri Gramin Digital Saksharta Abhiyaan, which has trained over 5 crore people in digital literacy, especially in rural areas, and Aadhaar-linked banking have improved access to financial services, a large portion of rural India still lacks formal credit options. Informal financial systems continue to thrive in rural areas, despite the growing presence of formal institutions. In Fiscal Year 2024, RBI's Financial Inclusion Index remains at just 62% and about 31% of the total credit outstanding loans in rural households are sourced from informal lenders, with this penetration being particularly high among the most economically vulnerable segments. This underscores the need for continued efforts to bridge the gap and ensure greater access to formal credit for all especially at the Bottom of the Pyramid segment.

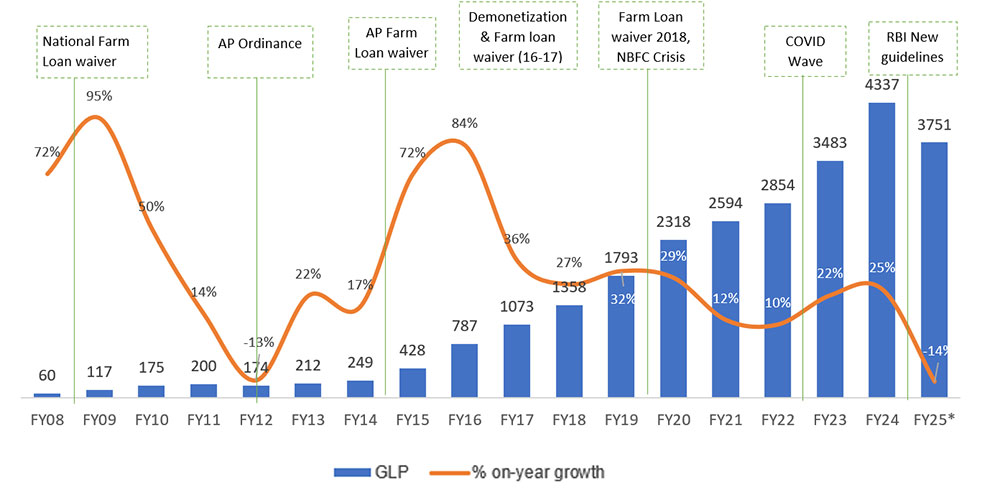

Note: Data includes data for Banks lending through joint liability group (JLG), SFBs, NBFC-MFIs, other NBFCs and non-profit MFIs. It excludes data for Banks lending through SHG; The Gross Loan Portfolio (GLP) amounts are in INR'000 Crs as at the end of each Fiscal year; Source: MFIN, Crisil Intelligence,*as per Equifax industry insights

Despite facing multiple disruptions over the past decade-including the Andhra Pradesh crisis, demonetization, the 2018 NBFC liquidity crunch, farm loan waivers, the Assam MFI bill, and the Covid-19 pandemic-India's microfinance sector has demonstrated remarkable resilience and adaptability. Progressive regulatory reforms introduced by the RBI in 2011 with creation of NBFC MFI's and in enhancements in 2022, coupled with critical legal clarifications in 2023 that reaffirmed the RBI's jurisdiction over lending activities vis-´-vis state, have bolstered the sector's structural integrity.

However, cracks have begun to surface once again. Starting in the last quarter of FY2023-24, the sector witnessed a rise in delinquencies, which translated into declining profitability and slower growth trajectories. In subsequent quarters of FY2024-25, the situation had further deteriorated. Non-Performing Assets (NPAs)-defined as loans overdue by more than 90 days-crossed the 5% mark, a stark contrast to the sector's historic reputation for 99%+ repayment rates and sub-1% credit costs.

This raises a critical question:

What ails microfinance in India today?

Despite its transformative role in advancing financial inclusion, India's microfinance sector-serving over 80 million borrowers-is currently grappling with a mix of deep-rooted and emerging challenges that threaten its ability to serve as a pillar of Viksit Bharat. Key issues include KYC authenticity, with reliance on Voter ID leading to duplication and weak borrower verification following the 2017 Supreme Court restriction on Aadhaar use. Inconsistent credit bureau data updates, varying from daily to monthly, hinder accurate lending decisions in an unsecured lending sector heavily dependent on real-time information. Post-pandemic, high employee attrition, exceeding 40%, has disrupted field relationships and hurt portfolio quality. At the borrower level, there's a shift toward over-borrowing, driven by demand for larger loans irrespective of repayment capacity, while some institutions are compounding the risk through irresponsible over-lending with relaxed underwriting & faceless Fintech lending. Governance lapses in certain entities-such as inadequate board oversight on growth, pricing, policies & management incentives-have further undermined stakeholder trust. The sector also suffers from a widespread misunderstanding on interest rates, where a 24% reducing balance rate is misinterpreted as interest burden of Rs 24 for a loan of Rs 100 for a year when it is actually just Rs 13.47! In the absence of formal credit the borrowers have to depend on informal lenders charging up to 240% - 10 times the average formal rate. Adding to the strain are external disruptions like inflation, wage stagnation, and climate shocks, fin-influencers or aggregators along with rising incidents of financial vandalism-populist loan waiver campaign promises that disrupt repayment culture and fuel wide spread defaults. Together, these challenges call for urgent, systemic intervention to preserve the sector's integrity and unleash its full potential.

"There is a school of thought that financial inclusion is not always good... but if we look at the pyramid of development in the country, the base is the broadest. If that is strong, the pyramid will be strong. When the purchasing power of the last person in the line will increase, the economy will grow." - Shri Narendra Modi, Hon'ble Prime Minister of India, Independence Day Speech, 2015

10 Actions to Empower Microfinance and Unlock Its Full Potential

To overcome the structural and operational challenges facing India's microfinance sector-and to enable it to become a pillar of Viksit Bharat-the following ten actionables are strongly recommended:

- 1. Reliable and Authenticated KYC: The foundation of responsible lending is knowing your customer. In the wake of the Supreme Court's Aadhaar ruling (2017), most MFIs have moved to Voter ID-which lacks uniqueness as of today. The government should help reinstate e-KYC via Aadhaar for regulated financial entities or mandate the use of C-KYC to ensure a unified, tamper-proof system. This will reduce duplication, fraud, and improve authentic KYC checks.

- 2. Real-Time Credit Bureau Reporting: Given the unsecured nature of microfinance loans, credit underwriting must rely on up-to-the-minute borrower data. The RBI should mandate daily credit bureau updates from all lenders on the microfinance portfolio, along with the integration of KYC-linked deduplication to prevent multiple simultaneous borrowings. This is crucial for risk mitigation and portfolio quality.

- 3. Sustainable and Transparent Pricing: Delivering doorstep, unsecured loans to remote communities involves real costs. A healthy microfinance ecosystem needs to attract long-term capital, which requires the potential for ~ 15%+ equity returns. The sector to double its outreach to make formal credit available widely will need an estimated over $4 billion in fresh equity investment.This will also help the entities to leverage through debt from the banking sector and/or the capital markets to grow.The industry also needs to shift to risk-based pricing -a real necessity for differentiation and reward for credit discipline.

- 4. Legal Protection Against Financial Vandalism: The proposed Ban on Unlawful Lending Activities (BULA) Bill from GoI is a welcome move to curb predatory & unregulated lending. But an equally important requirement is an Anti-Financial Vandalism (AFV) Bill, aimed at deterring individuals or groups who disrupt legitimate repayment through misinformation or populist promises of potential loan waivers. This will deter opportunistic interference and protect credit behaviour with institutional lending frameworks.

- 5. Climate Risk Protection for Borrowers: As climate shocks intensify, the livelihoods of microfinance borrowers-especially in agriculture and informal sectors-are increasingly vulnerable. The sector needs a climate-linked borrower protection product that covers interest costs during short-term repayment deferrals due to natural disasters, complementing existing credit life insurance schemes.

- 6. Workforce Development with Accountability: Microfinance can generate large-scale rural employment. A national program for certified financial inclusion professionals can prepare youth for roles across lending, insurance, pensions, and investments. Simultaneously, a sector-wide employee bureau must track misconduct, ensuring that fraud or negligence does not go unchecked across institutions as all this leads to higher credit costs.

- 7. Strengthening Corporate Governance: Lending to financially vulnerable populations is a responsibility-heavy activity, and boards must demonstrate active oversight. Institutions must adopt strong governance practices around growth strategy, provisioning norms, pricing models, and executive compensation & incentives, aligning them with long-term sustainability and regulatory expectations.

- 8. Reforming Collections and Recovery Frameworks: Collection is integral to lending. The sector must transition toward digital, cashless collections to reduce costs and increase efficiency. For recovery, enforcement mechanisms-within the RBI's Code of Conduct-should be allowed. Credit bureau reporting, Lok Adalats, co-applicant's and cross check of credit discipline for government benefit programs can instil a significant seriousness on repayment discipline. Not paying after taking a loan should not be an option - very critical to build a deep and robust credit market. Having said this, a distressed borrower programme is also required to address genuine stress possible in this segment

- 9. Empowered and Accountable SROs: RBI-recognized Self-Regulatory Organizations (SROs) should be empowered to enforce stricter operational norms beyond regulatory minimums. These include caps on number of lenders per borrower, overall indebtedness, no lending to 30+ DPD borrowers, and borrower education standards. In cases where lenders violate norms, SROs must have the authority to intervene, suspend collections, or recommend penalties.

- 10. Financial Literacy as a National Mission: Households earning under ₹3 lakh annually require targeted, structured financial education. While MFIs often provide this during loan onboarding, broader & ongoing efforts from RBI, NABARD, state governments, and the Ministry of Finance are needed to build a culture of responsible borrowing and credit awareness across India's base-of-the-pyramid populations.

Looking Ahead: The Path to a Viksit Bharat

For microfinance to become a true driver of India's inclusive growth, a comprehensive, multi-stakeholder approach is essential. By prioritizing policy advocacy, capacity building, digital innovation, public-private partnerships, and responsible lending, we can unlock the sector's potential and make financial inclusion a reality for all. With these reforms, microfinance can fuel equitable economic growth, transforming lives across the country. The question now is: Will we act to strengthen this vital sector, or will we allow it to falter? For those who hesitate to act on these critical imperatives, we must ask: Do we really want our Mother India Radha's to once again fall prey to the modern-day Sukhilalas?

Let us choose empowerment over exploitation-and build a Viksit Bharat that stands strong from the bottom of the pyramid.

[Manoj Kumar Nambiar is the Managing Director of Arohan Financial Services Limited, a NBFC MFI and is also the current Chair of the Governing board at MFIN, the sector SRO recognised by the RBI. Views expressed here are purely personal.]