Version : 11.0

Revision History

|

Version |

Author |

Description of changes |

Release Date |

|

1.0 |

Central Operations and Legal & Compliance |

|

April, 2018 |

|

2.0 |

Central Operations and Legal & Compliance |

|

June 2020 |

|

3.0 |

Customer Grievance Redressal Committee |

|

June 2021 |

|

4.0 |

Customer Grievance Redressal Committee |

|

November 2021 |

|

5.0 |

Customer Grievance Redressal Committee |

|

May 2023 |

|

6.0 |

Customer Grievance Redressal Committee |

|

February 2024 |

|

7.0 |

Customer Grievance Redressal Committee |

|

November 2024 |

|

8.0 |

Customer Grievance Redressal Committee |

|

February 2025 |

|

9.0 |

Customer Grievance Redressal Committee |

|

May 2025 |

|

10.0 |

Customer Grievance Redressal Committee |

Changes & Addition done basis on new RBI guidelines |

August 2025 |

|

11.0 |

Customer Grievance Redressal Committee |

|

November 2025 |

Approved by : The Board of the Company

Last Date of Approval : November 12, 2025

This document remains the property of Arohan Financial Services Limited. This policy is intended to guide the Customer Care Department within the Company and outside the Company. It is not to be used for any other purposes, copied, distributed or transmitted in any form or means or carried outside the Company premises without the prior written consent of the Company.

2. Monitoring of Grievance Resolution Quality...5

5. Credit Information Grievance Redressal...17

6. Data Reporting and Learning & Development Activities...18

This Standard Operating Procedure (SOP) on Customer Grievance Redressal for Arohan Financial Services Limited (“Arohan” or “the Company”) establishes a formal mechanism within the organization that enables customers to lodge their queries, complaints, grievances, and/or provide feedback or suggestions concerning their interactions with Arohan, including any financial assistance being considered for them. The Policy ensures that such issues are addressed in a timely and efficient manner, in accordance with the guidelines outlined herein.

Furthermore, this policy has been developed in compliance with the following master directions and guidelines of Reserve Bank of India (RBI)

Query categorization: -

|

SL No. |

Classification |

Category 1 |

Category 2 |

Category 3 |

Risk |

TAT |

|

1 |

Query |

Insurance related |

Claim related |

Credit Link Insurance (CLI) |

M |

3 |

|

2 |

Query |

Insurance related |

Claim related |

Health Insurance (HI) |

M |

3 |

|

3 |

Query |

Insurance related |

Claim related |

Credit Link Insurance (CLI) |

M |

3 |

|

4 |

Query |

Insurance related |

Claim related |

Arohan Privilege Insurance (CLI) |

M |

3 |

|

5 |

Query |

Insurance related |

Claim related |

Arohan Privilege Insurance (HI) |

M |

3 |

|

6 |

Query |

Insurance related |

Claim related |

Arohan MEL Insurance (CLI) |

M |

3 |

|

7 |

Query |

Insurance related |

Claim related |

Arohan MEL Insurance (HI) |

M |

3 |

|

8 |

Query |

Insurance related |

Documents related |

Credit Link Insurance (CLI) |

M |

3 |

|

9 |

Query |

Insurance related |

Documents related |

Health Insurance (HI) |

M |

3 |

|

10 |

Query |

Insurance related |

Documents related |

Arohan Privilege Insurance (CLI) |

M |

3 |

|

11 |

Query |

Insurance related |

Documents related |

Arohan Privilege Insurance (HI) |

M |

3 |

|

12 |

Query |

Insurance related |

Documents related |

Arohan MEL Insurance (CLI) |

M |

3 |

|

13 |

Query |

Insurance related |

Documents related |

Arohan MEL Insurance (HI) |

M |

3 |

|

14 |

Query |

Insurance related |

Process related |

Credit Link Insurance (CLI) |

M |

3 |

|

15 |

Query |

Insurance related |

Process related |

Health Insurance (HI) |

M |

3 |

|

16 |

Query |

Insurance related |

Process related |

Arohan Privilege Insurance (CLI) |

M |

3 |

|

17 |

Query |

Insurance related |

Process related |

Arohan Privilege Insurance (HI) |

M |

3 |

|

18 |

Query |

Insurance related |

Process related |

Arohan MEL Insurance (CLI) |

M |

3 |

|

19 |

Query |

Insurance related |

Process related |

Arohan MEL Insurance (HI) |

M |

3 |

|

20 |

Query |

Loan |

Application & Processing |

Loan rejection |

M |

3 |

|

21 |

Query |

Loan |

Application & Processing |

Loan related |

M |

3 |

|

22 |

Query |

Loan |

Application & Processing |

Branch contact details |

M |

3 |

|

23 |

Query |

Loan |

Application & Processing |

Arohan Privilege application |

M |

3 |

|

24 |

Query |

Loan |

Application & Processing |

Arohan MEL application |

L |

3 |

|

25 |

Query |

Loan |

Center related |

Group member status |

M |

3 |

|

26 |

Query |

Loan |

Loan related information |

Product related |

M |

3 |

|

27 |

Query |

Loan |

Loan related information |

Product related |

M |

3 |

|

28 |

Query |

Loan |

Loan related information |

Product related |

M |

3 |

|

29 |

Query |

Loan |

Loan related information |

Product related |

M |

3 |

|

30 |

Query |

Loan |

Policy related |

Wrong mobile number Query |

M |

3 |

|

31 |

Query |

Loan |

Policy related |

KYC data deletion query |

M |

3 |

|

32 |

Query |

Loan |

Relocation |

Branch contact details |

L |

3 |

|

33 |

Query |

Loan |

Re-payments |

Digital repayment |

M |

3 |

|

34 |

Query |

Loan |

Re-payments |

Arohan Privilege repayment |

M |

3 |

|

35 |

Query |

Loan |

Re-payments |

Arohan MEL repayment |

M |

3 |

|

36 |

Query |

Loan |

Re-payments |

Advance emi |

M |

3 |

|

37 |

Others |

Others |

Call drop |

Call disconnected |

L |

3 |

|

38 |

Query |

Others |

Other |

Promotional offers |

L |

3 |

|

39 |

Query |

Others |

Other |

General |

L |

3 |

|

40 |

Query |

Others |

Other |

HR related |

L |

3 |

|

41 |

Query |

Others |

Other |

HR related |

L |

3 |

|

42 |

Query |

Others |

Other |

Language barrier |

L |

3 |

|

43 |

Query |

Third-party products_Non-Financial |

Information related |

Cross Sell |

M |

3 |

|

44 |

Query |

Loan |

Re-payments |

Repayment status |

M |

3 |

|

46 |

Query |

Loan |

CIC related |

Credit bureau |

M |

3 |

|

47 |

Query |

Others |

Information related |

Complaints/Query status |

M |

3 |

|

48 |

Query |

Loan |

Information related |

Account related |

M |

3 |

|

49 |

Query |

Loan |

Loan closure |

Arohan MEL loan Preclosure |

M |

3 |

|

50 |

Query |

Loan |

Closure |

OTS/Sandhi account settled but in FIS account is still open |

M |

3 |

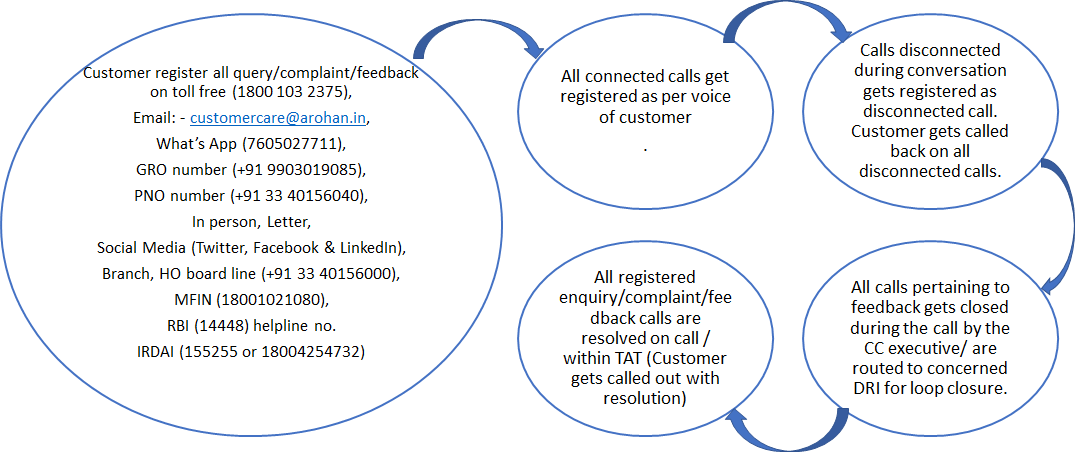

Customers can lodge grievances related to deviations from standard norms, staff behavior, products, services, and non-adherence to the Fair Practices Code through the following channels:

i. Complaints in Person

ii. Through Letter

Customers may send a written grievance addressed to the Grievance Redressal Officer (GRO) at the following address:

The Grievance Redressal Officer: Mr. Bikash Kumar Gupta

Arohan Financial Services Limited

PTI Building, 4th Floor, DP Block, DP-9, Sector-V,

Salt Lake, Kolkata - 700091, West Bengal

|

Record name |

Storage Location |

Alternate Source |

|

Customer complaint at HO in person (Hard copy) |

Cabinet number 8 |

ZOHO CRM |

iii. Through E-mails

Customers may submit grievances via email at customercare@arohan.in.

Customers may also submit their grievances via email. The email should include:

Complaints received by email will be acknowledged via email.

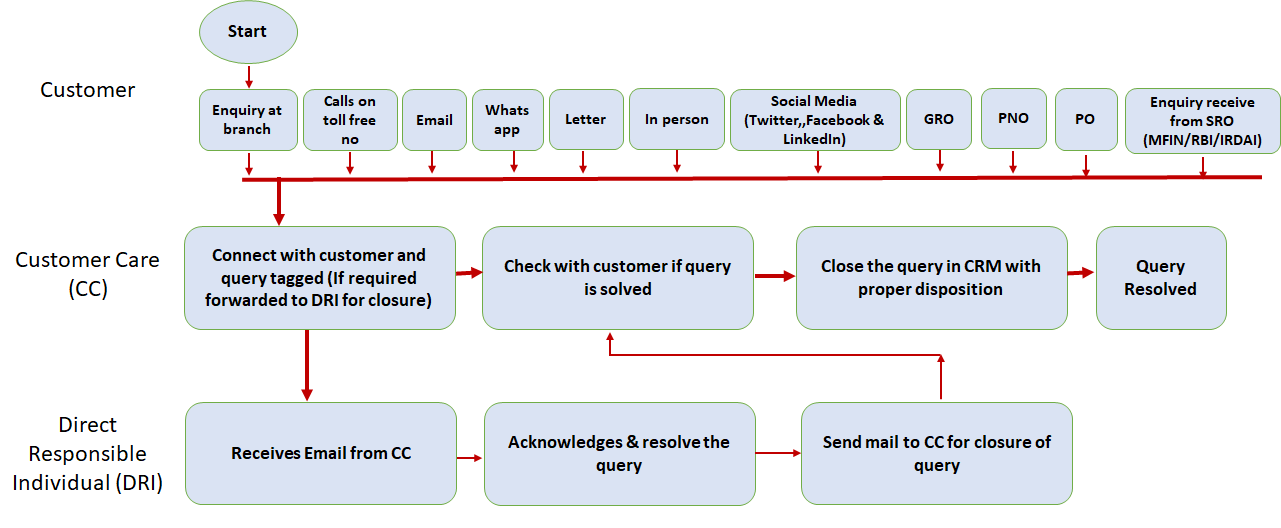

iv. Complaints through Call Centre

Customers can register complaints by calling the toll-free number 1800-103-2375, available Monday to Friday, 10 am to 6 pm.

Our multilingual customer insights team is equipped to assist customers in multiple languages. Queries and complaints are handled in accordance with established procedures, ensuring appropriate and timely resolutions.

We utilize a cloud-based Customer Relationship Management (CRM) system to enhance customer experience and efficiently track and resolve complaints.

v. Complaints through WhatsApp

Customers can also register complaints via WhatsApp at 76050 27711, available Monday to Friday, from 10:00 AM to 6:00 PM.

All complaints received through WhatsApp will be addressed in accordance with our Customer Grievance Mechanism to ensure fair and timely resolution.

Back end Process (Complaint & Enquiry): -

|

Data Input |

Source & Sharing |

|

Enquiry/Complaint/Feedback |

Toll Free/Email/What’s App/Social Media/In Person/Letter/Branch/GRO/PNO/PO/MFIN/RBI/IRDAI |

|

Enquiry/Complaint closed with customer consent |

Quarterly survey done to capture feedback |

|

Non-Contactable Customer |

The closure status is shared via an alternative contact method if available in the system; otherwise, the status is communicated once the customer reconnects. |

|

Insurance related Complaints |

|

|

Complaint (related to insurance product, service, demand, notice or claim) |

For complaints related to insurance products, services, demands, notices, or claims, intimation is sent to the concerned Insurance Company if further intervention is required. This notification is typically made within 3 working days from the date the complaint is lodged. |

|

Complaint Records Maintenance |

By the 15th of every month, a report is shared with the Central Hub team. |

Request categorization: -

|

Sl |

Classification |

Category 1 |

Category 2 |

Category 3 |

|

1 |

Request |

Loan |

Disbursement |

Loan Request |

|

2 |

Request |

Loan |

Disbursement |

Arohan Privilege loan request |

|

3 |

Request |

Loan |

Disbursement |

Arohan MEL loan request |

|

4 |

Request |

Loan |

Documents related |

Loan related |

|

5 |

Request |

Loan |

Re-payments |

Repayment cycle change |

|

6 |

Request |

Loan |

Re-payments |

Delay payment |

|

|

|

|

|

|

|

8 |

Request |

Loan |

Loan closure |

Loan Preclosure |

|

9 |

Request |

Loan |

Loan closure |

Arohan Privilege loan Preclosure |

|

10 |

Request |

Loan |

Loan closure |

Arohan MEL loan Preclosure |

|

11 |

Request |

Loan |

Loan closure |

Payment related |

|

12 |

Request |

Loan |

Loan closure |

Account related |

|

13 |

Request |

Insurance related |

Premium Refund related |

Refund/cancellation of CLI/HI query |

|

14 |

Request |

Third-party products_Non-Financial |

Refund/Cancellation |

Refund/cancellation of cross sell product |

|

15 |

Request |

Loan |

Information related |

Account related |

|

16 |

Request |

Loan |

Re-payments |

Paid extra amount |

|

17 |

Request |

Loan |

Re-payments |

Paid to wrong loan id |

Complaint categorization: -

|

Sl |

Classification |

Category 1 |

New Category 2 |

Category 3 |

Risk |

TAT |

|

1 |

Complaints |

Insurance related |

Claim related |

CLI-claim not received after submission of the documents |

H |

5 |

|

2 |

Complaints |

Insurance related |

Claim related |

CLI-claim not received after submission of the documents under Arohan Privilege loan |

H |

5 |

|

3 |

Complaints |

Insurance related |

Claim related |

CLI-claim not received after submission of the documents under MEL loan |

H |

5 |

|

4 |

Complaints |

Insurance related |

Claim related |

HI- claim not received after submission of the documents |

H |

5 |

|

5 |

Complaints |

Insurance related |

Claim related |

HI- claim not received after submission of the documents under Arohan Privilege loan |

H |

5 |

|

6 |

Complaints |

Insurance related |

Claim related |

HI- claim not received after submission of the documents under MEL loan |

H |

5 |

|

7 |

Complaints |

Insurance related |

Claim related |

HI- Claim amount received is less than the claimed amount |

H |

4 |

|

8 |

Complaints |

Insurance related |

Documents related |

CLI- Claim Documents not getting collected by Field team |

H |

4 |

|

9 |

Complaints |

Insurance related |

Documents related |

CLI- claim not received after submission of the documents |

H |

5 |

|

10 |

Complaints |

Insurance related |

Documents related |

HI- claim not received after submission of the documents |

H |

5 |

|

11 |

Complaints |

Insurance related |

Documents related |

HI-Claim Documents not collected by field team |

H |

4 |

|

12 |

Complaints |

Insurance related |

Documents related |

CLI- claim not received after submission of the documents under Arohan Privilege loan |

H |

5 |

|

13 |

Complaints |

Insurance related |

Documents related |

HI--claim not received after submission of the documents under Arohan Privilege loan |

H |

5 |

|

14 |

Complaints |

Insurance related |

Documents related |

CLI- claim not received after submission of the documents under MEL loan |

H |

5 |

|

15 |

Complaints |

Insurance related |

Documents related |

HI--claim not received after submission of the documents under MEL loan |

H |

5 |

|

16 |

Complaints |

Insurance related |

Mis selling/Force selling |

Customer is forced to buy CLI/HI product |

H |

4 |

|

17 |

Complaints |

Insurance related |

Payment related |

Receipt of premium payment |

H |

4 |

|

18 |

Complaints |

Insurance related |

Payment related |

Insurance amount is withheld by the MFI |

H |

4 |

|

19 |

Complaints |

Insurance related |

Process related |

CLI- claim not tagged after submission of all documents |

H |

5 |

|

20 |

Complaints |

Insurance related |

Product related |

Product/Plan feature not informed |

M |

4 |

|

21 |

Complaints |

Insurance related |

Refund related |

Refund/cancellation of CLI/HI premium |

H |

7 |

|

22 |

Complaints |

Insurance related |

Re-payments |

Repayment not stopped after death of insured person |

H |

4 |

|

23 |

Complaints |

Loan |

Account closure related |

Loan Account not closed after insurance claim settlement |

H |

4 |

|

24 |

Complaints |

Loan |

Application & Processing |

Products details not informed |

M |

4 |

|

25 |

Complaints |

Loan |

Application & Processing |

Fee demanded for loan application |

H |

4 |

|

26 |

Complaints |

Loan |

Application & Processing |

Fee charged for loan application |

H |

4 |

|

27 |

Complaints |

Loan |

Application & Processing |

Loan application not taken |

M |

4 |

|

28 |

Complaints |

Loan |

Application & Processing |

Acknowledgement slip not given for loan application |

M |

4 |

|

29 |

Complaints |

Loan |

Application & Processing |

Status of loan application not informed |

M |

4 |

|

30 |

Complaints |

Loan |

Application & Processing |

Delay in processing/sanctioning of loan post submission of application |

M |

4 |

|

31 |

Complaints |

Loan |

Application & Processing |

Loan rejection reason not disclosed/contesting rejection reason |

M |

4 |

|

32 |

Complaints |

Loan |

Arohan MEL loan related |

Issue related to MEL loan |

M |

5 |

|

33 |

Complaints |

Loan |

Arohan Privilege loan related |

Issue related to Arohan privilege loan |

M |

5 |

|

34 |

Complaints |

Loan |

Center related |

Issue with group members/centre leader |

M |

5 |

|

35 |

Complaints |

Loan |

Center related |

Bribe demanded |

M |

5 |

|

36 |

Complaints |

Loan |

CIC related |

Dispute with Credit Information Report (CIR) |

H |

30 |

|

|

|

|

|

|

|

|

|

38 |

Complaints |

Loan |

Closed loan product |

ICASH loan related |

H |

4 |

|

39 |

Complaints |

Loan |

Closure |

Pre-closure not allowed |

M |

4 |

|

40 |

Complaints |

Loan |

Closure |

Penalty demanded/charged for pre-closure |

M |

4 |

|

41 |

Complaints |

Loan |

Closure |

Forced for pre-closure |

M |

4 |

|

42 |

Complaints |

Loan |

Closure |

Final payment acknowledgement slip |

M |

5 |

|

43 |

Complaints |

Loan |

Closure |

OTS/Sandhi account settled but in FIS account is still open |

M |

5 |

|

44 |

Complaints |

Loan |

Closure |

All EMI paid but account not closed |

M |

5 |

|

45 |

Complaints |

Loan |

Complaints support related |

Complaint is not registered at branch |

M |

4 |

|

46 |

Complaints |

Loan |

Complaints support related |

Complaint is not resolved |

M |

4 |

|

47 |

Complaints |

Loan |

Data Privacy |

Breach of personal data |

H |

4 |

|

48 |

Complaints |

Loan |

Data Privacy |

Misuse of KYC |

H |

4 |

|

49 |

Complaints |

Loan |

Disbursement |

Loan approved/sanctioned but disbursement not received |

M |

5 |

|

50 |

Complaints |

Loan |

Disbursement |

Disbursement amount received is less/more than sanctioned amount |

M |

5 |

|

51 |

Complaints |

Loan |

Disbursement |

Disbursement amount not received post sharing pending documents for RE-NEFT |

M |

5 |

|

52 |

Complaints |

Loan |

Disbursement |

Disbursement amount not credited in bank account |

M |

5 |

|

53 |

Complaints |

Loan |

Disbursement |

Arohan Privilege loan disbursement not credited in bank account |

M |

3 |

|

54 |

Complaints |

Loan |

Disbursement |

Arohan MEL Loan disbursement not credited in bank account |

M |

3 |

|

55 |

Complaints |

Loan |

Disbursement |

Loan applied without customer's consent |

H |

7 |

|

56 |

Complaints |

Loan |

Disbursement |

Loan disbursed without customer's consent |

H |

7 |

|

57 |

Complaints |

Loan |

Disbursement |

Loan converted without customer's consent |

H |

5 |

|

58 |

Complaints |

Loan |

Documents related |

Loan agreement not received |

M |

4 |

|

59 |

Complaints |

Loan |

Documents related |

Loan card not received |

M |

4 |

|

60 |

Complaints |

Loan |

Excessive charges |

Un-authorized collection of charges |

H |

7 |

|

61 |

Complaints |

Loan |

Financial Misappropriation related |

Complaints tending to financial misappropriation |

H |

30 |

|

62 |

Complaints |

Loan |

Incomplete disclosure |

Not informed terms and condition |

M |

4 |

|

63 |

Complaints |

Loan |

Loan related |

Inorganic business |

M |

4 |

|

64 |

Complaints |

Loan |

Payment related |

Repayment collected after death has not been refunded |

H |

4 |

|

65 |

Complaints |

Loan |

Policy related |

Policy violation |

M |

4 |

|

66 |

Complaints |

Loan |

Policy related |

Subjected to discrimination |

M |

4 |

|

67 |

Complaints |

Loan |

Policy related |

Wrong mobile number updated in system |

M |

7 |

|

68 |

Complaints |

Loan |

Policy related |

Wrong mobile number not reflecting in system |

M |

5 |

|

69 |

Complaints |

Loan |

Re-payments |

Repayments done not acknowledged/updated |

H |

3 |

|

70 |

Complaints |

Loan |

Re-payments |

Online repayment related issues |

H |

4 |

|

71 |

Complaints |

Loan |

Re-payments |

Online repayment related issues Arohan Privilege |

H |

4 |

|

72 |

Complaints |

Loan |

Re-payments |

Online repayment related issues Arohan MEL |

H |

4 |

|

73 |

Complaints |

Loan |

Re-payments |

Repayment demanded/collected before due date |

H |

4 |

|

74 |

Complaints |

Loan |

Re-payments |

Payment related |

M |

5 |

|

75 |

Complaints |

Loan |

Staff behaviour |

Subjected to indecent behaviour |

H |

4 |

|

76 |

Complaints |

Third-party products_Non-Financial |

Delivery related |

Delay in delivery of product |

H |

4 |

|

77 |

Complaints |

Third-party products_Non-Financial |

Delivery related |

Cross sell product not received |

H |

7 |

|

78 |

Complaints |

Third-party products_Non-Financial |

Incomplete disclosure |

Not informed about features /charges of third-party/cross-sell product |

H |

4 |

|

79 |

Complaints |

Third-party products_Non-Financial |

Mis selling/Force selling |

Unaware of cross sell product purchase, forced to buy third-party/cross-sell product |

H |

4 |

|

80 |

Complaints |

Third-party products_Non-Financial |

Process related |

Receipts/ documents not received for cross sell product |

H |

4 |

|

81 |

Complaints |

Third-party products_Non-Financial |

Process related |

Loan application cancelled although cross sell amount deducted |

H |

5 |

|

82 |

Complaints |

Third-party products_Non-Financial |

Quality related |

Product quality issues |

H |

4 |

|

83 |

Complaints |

Third-party products_Non-Financial |

Refund related |

Refund/cancellation of cross sell product |

H |

7 |

Process Document Outbound: Arohan's Customer Care Cell conducts outbound calls Surveys:

|

Sl no |

Survey Name (Mandatory) |

Need Based Survey |

|

1 |

Client Satisfaction survey |

Ad-hoc (Based on request raised from different departments) |

|

2 |

Dropout survey |

|

|

3 |

Cross sell product satisfaction survey |

|

|

4 |

PPI survey |

|

|

5 |

Slippage calling |

|

|

6 |

CSAT call |

|

|

7 |

Voluntary insurance claim satisfaction survey |

|

|

8 |

Inactive RE calling |

|

|

9 |

Confirming death information |

|

|

10 |

Customer didn’t opted CLI (Credit Link Insurance) |

|

|

11 |

Customer acquisition calling |

Surveys include brief questionnaires on feedback regarding products, processes, service quality, and staff behaviour.

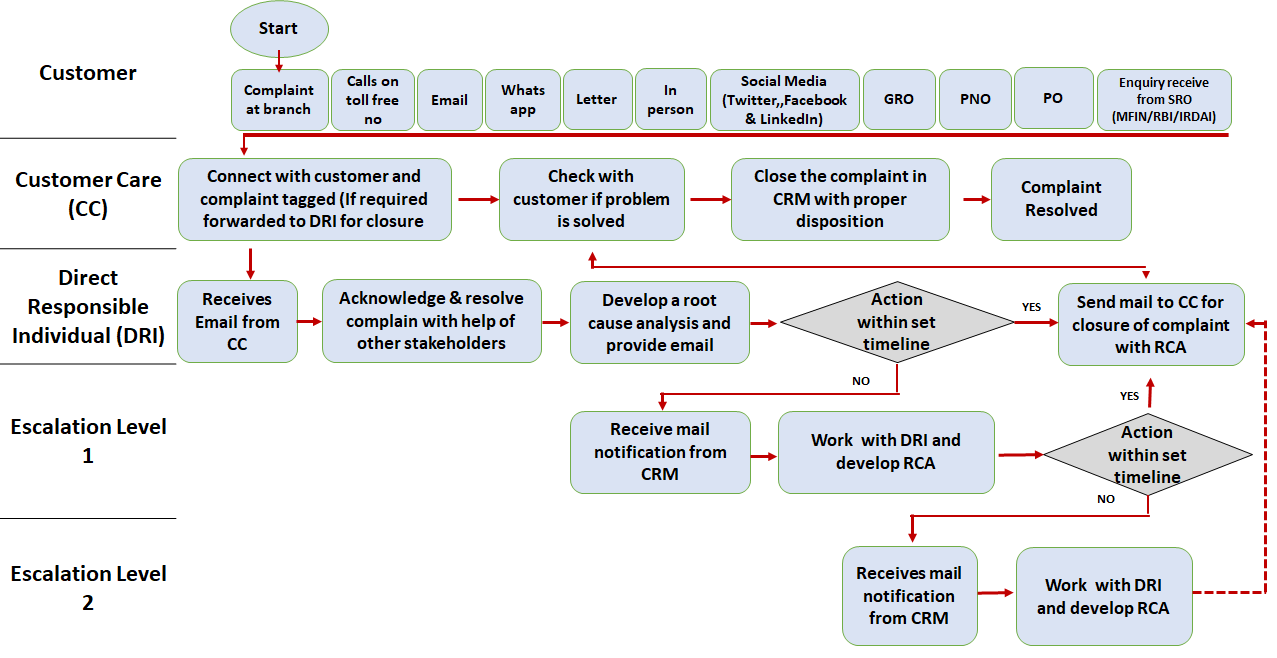

Through Helpline Number & Email to Grievance Redressal Officer (GRO):

If a complaint lodged at the branch or through customer care is not resolved within the specified Turnaround Time (TAT), or if the customer is dissatisfied with the resolution provided, they may escalate the matter to the Grievance Redressal Officer (GRO).

The contact details of the GRO are prominently displayed on our website, as well as at our branches and offices.

The GRO will review the complaint and provide a resolution within 10 working days from the date of escalation.

Grievance Redressal Officer (GRO) Contact Details:

Name: Mr. Bikash Kumar Gupta

Address: PTI Building, 4th Floor, DP Block, DP-9, Sector-V, Salt Lake, Kolkata – 700091, West Bengal

Phone: 033-40427726, 9903019085 (Monday to Friday, 10 am to 6 pm)

Email: gro@arohan.in

Through Helpline Number & Email to Principal Nodal Officer (PNO):

If a complaint escalated to the Grievance Redressal Officer (GRO) remains unresolved beyond the stipulated Turnaround Time (TAT) or the customer is not satisfied with the resolution, the complaint may be further escalated to the Principal Nodal Officer (PNO).

The PNO's contact details will be prominently displayed on our website, and at all branches and offices for customer convenience.

The PNO will review the matter and provide a response within 5 working days from the date of escalation.

Principal Nodal Officer (PNO) Contact Details:

Name: Mr. Anup Kumar Gupta

Address: PTI Building, 4th Floor, DP Block, DP-9, Salt Lake City, Kolkata – 700091

Phone: 033-40156040 (Monday to Friday, 10 am to 6 pm)

Email: anup.gupta@arohan.in

Complaints Through RBI/NBFC Ombudsman:

Approach to RBI Ombudsman:

If a complaint is not resolved within 30 days of being lodged with the Company, or if the customer is dissatisfied with the final response, they may escalate the matter to the RBI Ombudsman under the Reserve Bank - Integrated Ombudsman Scheme (RB-IOS).

Alternatively, customer may appeal to the Officer-in-charge, Department of Supervision, Reserve Bank of India, 5th floor 15, Netaji Subhas Road, Kolkata – 700001, Tel.: 033-22312892

Any customer who has a grievance against the Company on any one or more of the grounds mentioned in Clause 9 of the Reserve Bank - Integrated Ombudsman Scheme, 2021 for NBFCs issued by RBI on November 12, 2021 for details visit (https://rbidocs.rbi.org.in/rdocs/content/pdfs/RBIOS2021_amendments05082022.pdf), may himself/herself or through their authorized representative, make a complaint to the Ombudsman as specified in Clause 11 of the Reserve Bank - Integrated Ombudsman Scheme, 2021.The details Salient Features of The RBI Integrated Ombudsman Scheme, 2021.

Complaints received through MFIN (Micro Finance Institution Network)

Customer may register his/her complaint on toll free number -1800 102 1080 with MFIN.

In addition to the above, for specifically Insurance related query or grievances, a customer can either contact the Insurance Company’s Customer Care by referring to his/her details given in his/her Certificate of Insurance (COI) or can register his/her complaint in the following manner:

Principal Officer

If the resolution provided by the Customer Care Help Desk does not meet the expectation of the Customer or the customer has not received any response, the Customer may write to:

Principal officer

Arohan Financial Services Limited,

PTI Building, 4th Floor, DP Block, DP-9, Sector-V, Salt Lake, Kolkata – 700091, West Bengal

Email Id: po_insurance@arohan.in

The Principal Officer / customer care department shall also follow up with the Insurance company for providing speedy resolution.

Insurance company

The Customer may write to the concerned Insurance company by obtaining their contact details from their website or from the Certificate of Insurance shared with the Customer by the Insurance Company in hard / soft copy form.

The Insurance Company and Arohan will mutually co-ordinate for end-to-end fair resolution of the complaint within 14 days of receiving all required information and documents.

Integrated Grievance Management System (IGMS)

In-case the complaint remains unresolved by the Insurance Company / Arohan at any point of time, then the Customer can:

Insurance Ombudsman

If the Customer’s complaint still remains unresolved, the Customer can reach out to the Insurance Ombudsman.

For anonymous calls received on the toll-free number, the individual will be provided with the email ID whistleblower@arohan.in to report their concerns securely.